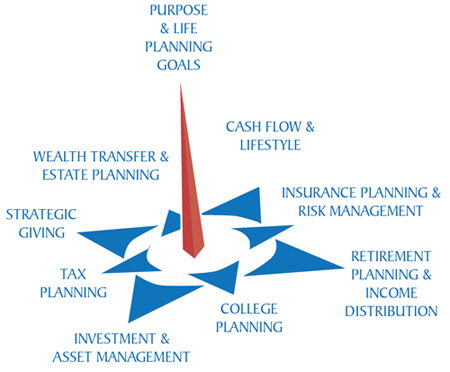

The above Planning Compass illustrates each phase of the financial and life planning process. Click for a description of each phase:

-

Purpose and Life Planning Goals

This is the foundation of any effective planning. It is critical to consider what is important to us in life. What are our values? What do we believe in? What are we truly passionate about? Where does our significance come from? By answering these questions, we can begin to make financial plans that coincide with our personal goals and desires. If we do not consider these things, we may find that we've accomplished a lifetime of material and financial achievements and still feel like we're searching for greater personal significance. We help clients through this process. Through our partnership together, our clients begin to find not only financial success, but they are able to apply their financial resources to accomplish their life goals.

-

Cash Flow and Lifestyle

We should give careful consideration to how we utilize our resources given that every spending decision has an impact on our ability to achieve both our short and long-term goals. This can be effectively accomplished by establishing and operating on a family cash flow and lifestyle plan. After creating life and financial goals, we can help clients review their spending habits, establish a cash flow and lifestyle plan and provide encouragement and accountability to sticking with this plan.

-

Insurance Planning and Risk Management

Life insurance should play an integral part in any financial plan. Buying life insurance does not demonstrate a lack of faith but rather prudent planning. We believe that having enough life insurance to provide for family needs is a good stewardship decision. We assess our clients' insurance needs, review current levels and types of coverage and policies, and make recommendations on which types, amounts and providers can most cost effectively meet our clients' needs. We do not earn any commissions on these recommendations, so our clients' can rest assured that the recommendations we are making are in their best interest.

-

Retirement Planning and Income Distribution

With all of the immediate demands in our lives, it is often difficult to step back and look years down the road. However, prudent planning today can meet our income needs many years into the future. Time is a critical component of retirement planning and it should be a critical piece of most clients' financial plans. Once our clients' reach retirement age, it becomes critical to efficiently manage income distribution to minimize the negative effect of income and estate taxes. Through detailed cash flow projections, we help clients' determine what their future income need may be and what they need to save today to meet their future needs.

-

Education Planning

Next to the purchase of a home, paying for our children's education will most likely be the most significant expense of our lives. It is not only important to save FOR our children's education, but also to save ON THE COST OF their education. Effective planning can potentially help our clients' save thousands of dollars on the cost of their children’s education.

-

Investment and Asset Management

After we have established goals, it becomes critical that the financial resources we have set aside to achieve them are working in our best interest. This means effectively managing not only returns, but also risk. We understand that our clients' will react differently to different investments in different economic cycles. Therefore, we are careful to fully understand our clients' tolerance for risk and then recommend investments that are appropriate. We don't recommend "stocks of the day", rather we apply asset allocation, diversification and other sound investment principles that have proven to be effective over long periods of time. We also make monitoring the investments we recommend a top priority. As a Fee-Only firm, Collie Financial Planning, Inc. is compensated solely by its clients, and does not accept commissions or compensation of any kind based on the products we recommend. By eliminating the inherent conflicts of interest that are so prevalent in the financial advisory world, particularly those associated with commissions and product sales incentives, our clients know that we are working in their best interests, not for the interests of a brokerage firm, a bank, and/or their shareholders. There are no products of the month or sales goals to hit. We are 100% client focused, 100% of the time.

-

Tax Planning

Taxes should never be a source of cash-flow problems as they can always be adequately planned for. Tax planning should never be the ultimate driving force in financial decisions. Wise tax planning is a critical component of being a good steward of our financial assets. In many ways income taxes are an indicator of our blessings. We work with our clients' CPA®'s to ensure that they are managing taxes in the best way.

-

Strategic Giving

We believe that giving not only benefits the recipient, it also benefits the giver. Our clients can find a great sense of gratification in sharing what they've been blessed with. We help clients plan their giving so that it is most effective in accomplishing their personal and financial goals.

-

Wealth Transfer and Estate Planning

Wealth transfer is different from estate planning in that it begins during one’s lifetime and it considers the impact on the beneficiary as its primary objective. Once these considerations have been made, we partner with our clients' attorney to make sure that their estate planning is done in a way that most efficiently maximizes benefits to clients' beneficiaries and charitable organizations while minimizing the negative effects of estate taxes.