S&P 500 Closed Up 2.4% Friday After A -10% Correction

Published Friday, January 28, 2022 at: 8:23 PM EST

Is the market correction done?

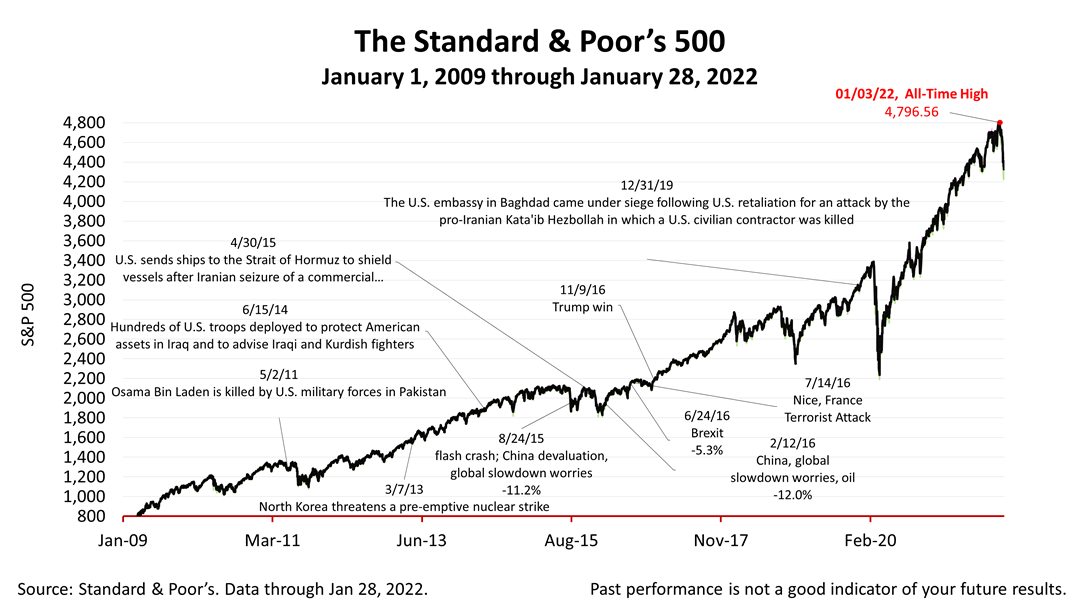

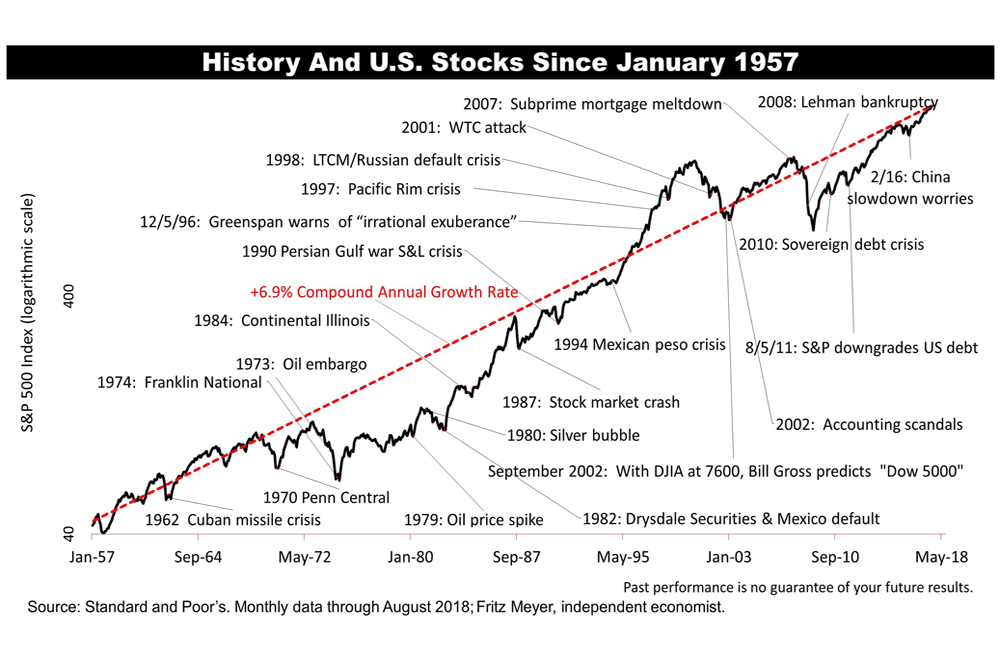

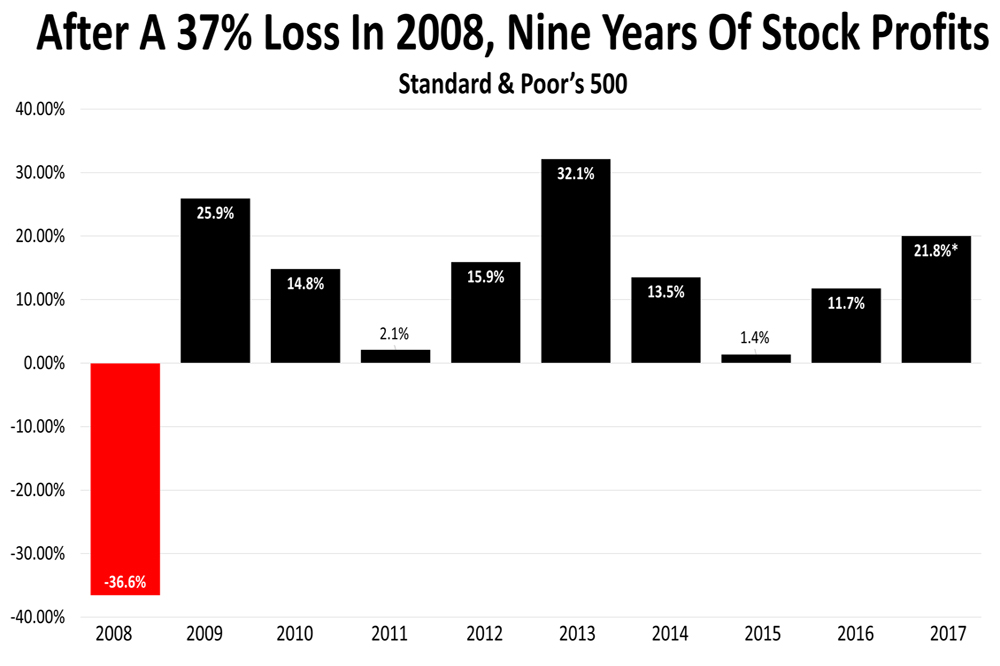

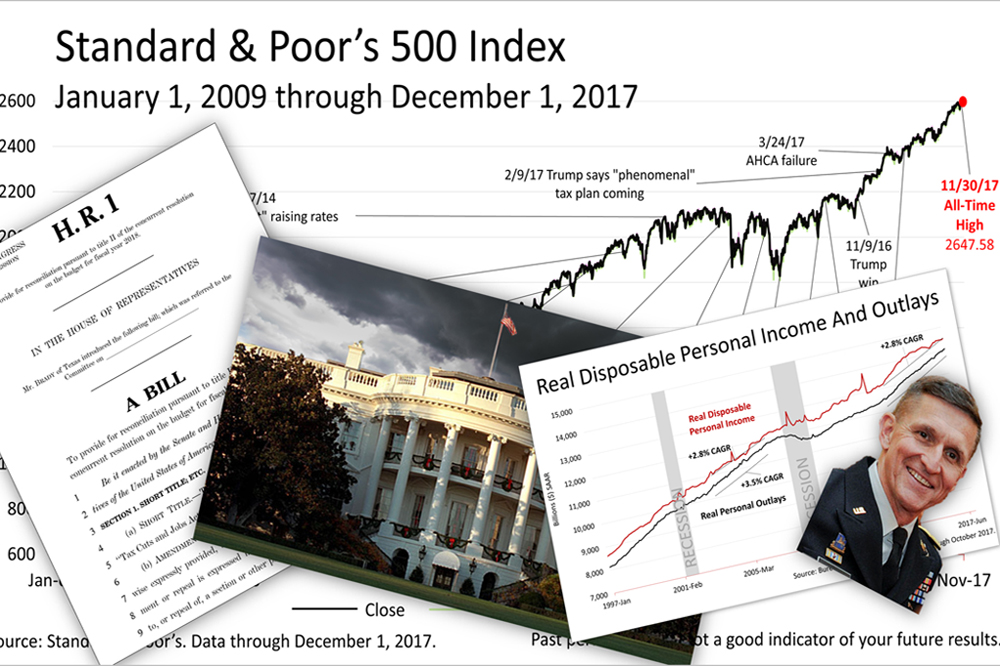

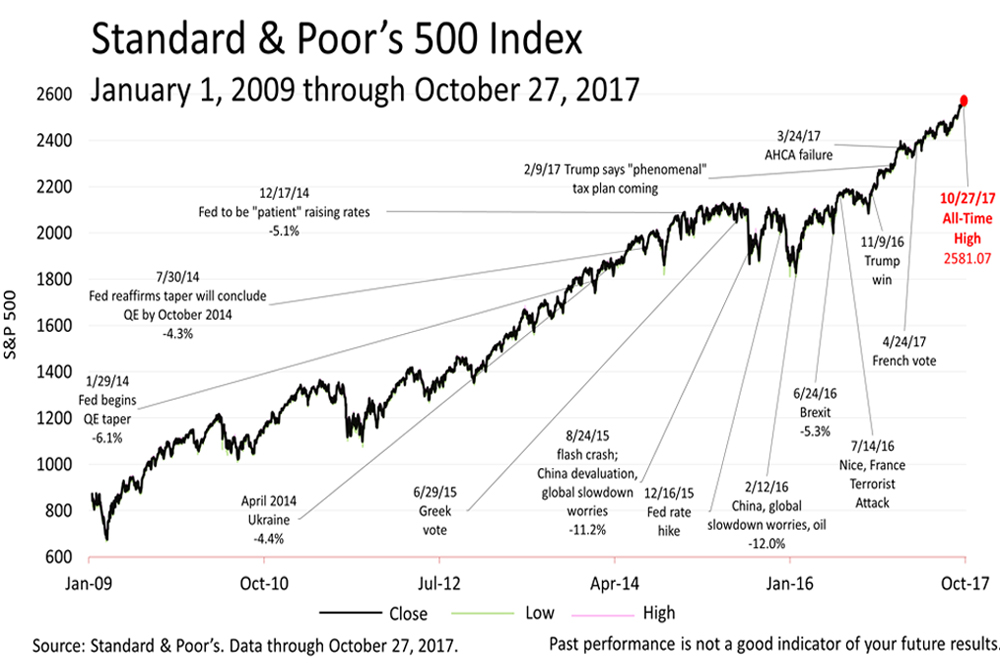

The Standard & Poor’s 500 stock index had closed yesterday 10% lower than its all-time high of Jan. 3, officially meeting the definition of a “market correction.”

Today it rebounded sharply, by 2.4%. The correction could be over.

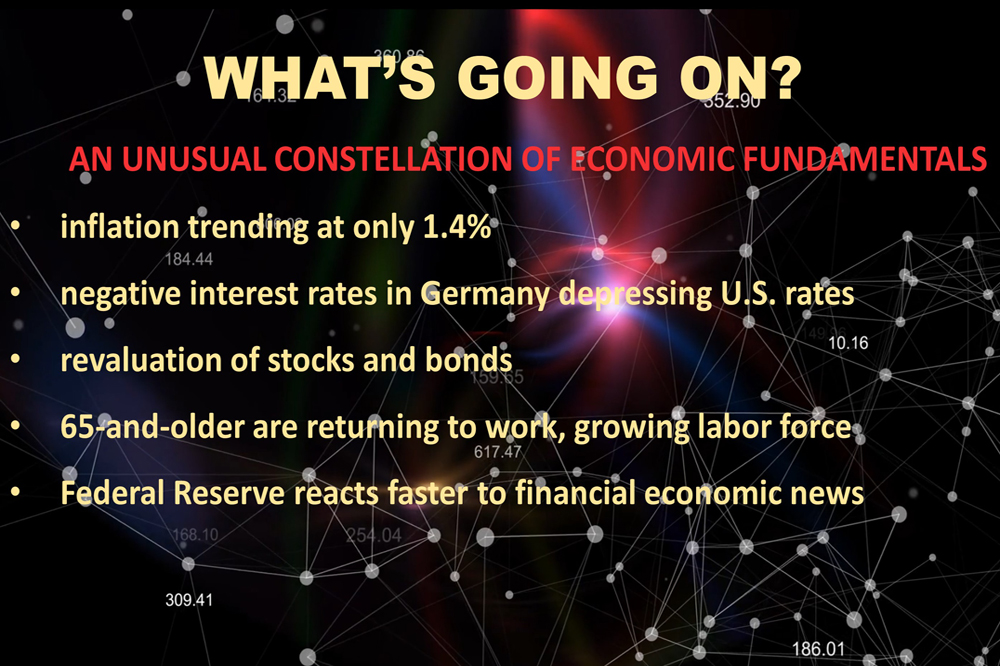

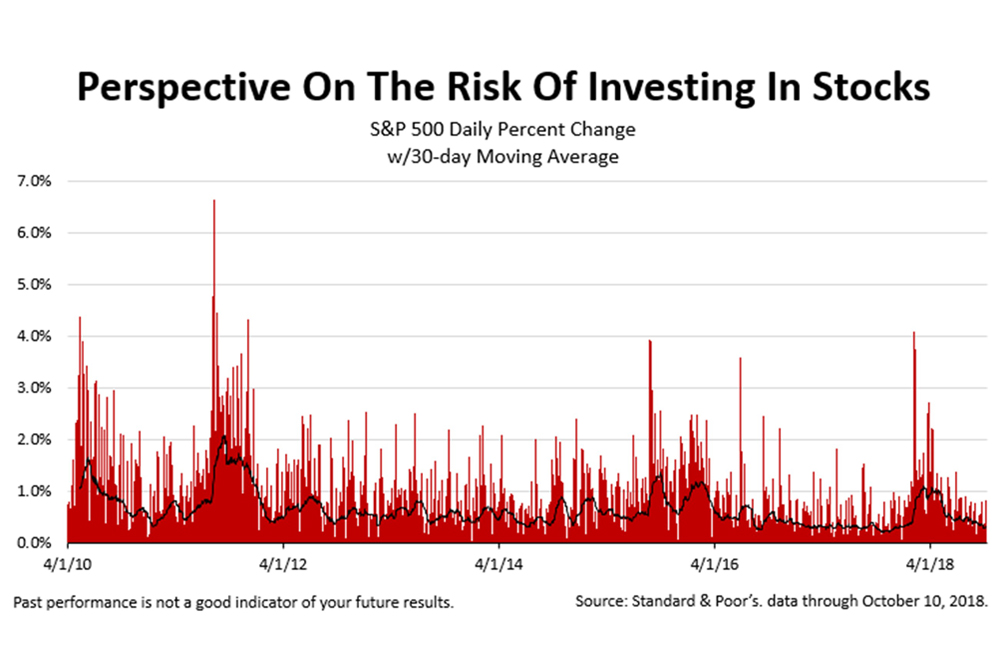

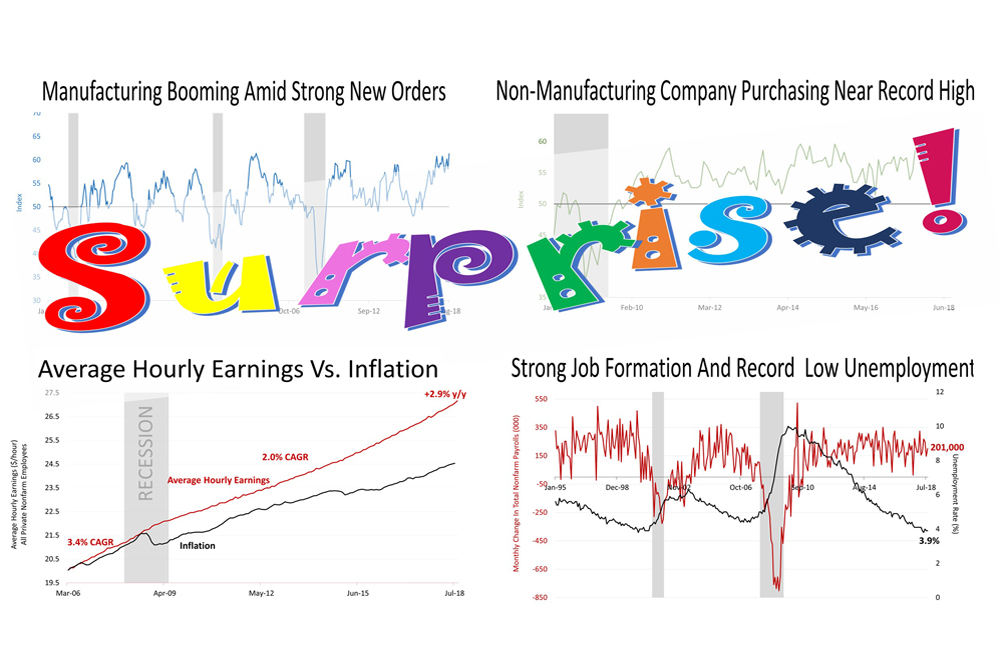

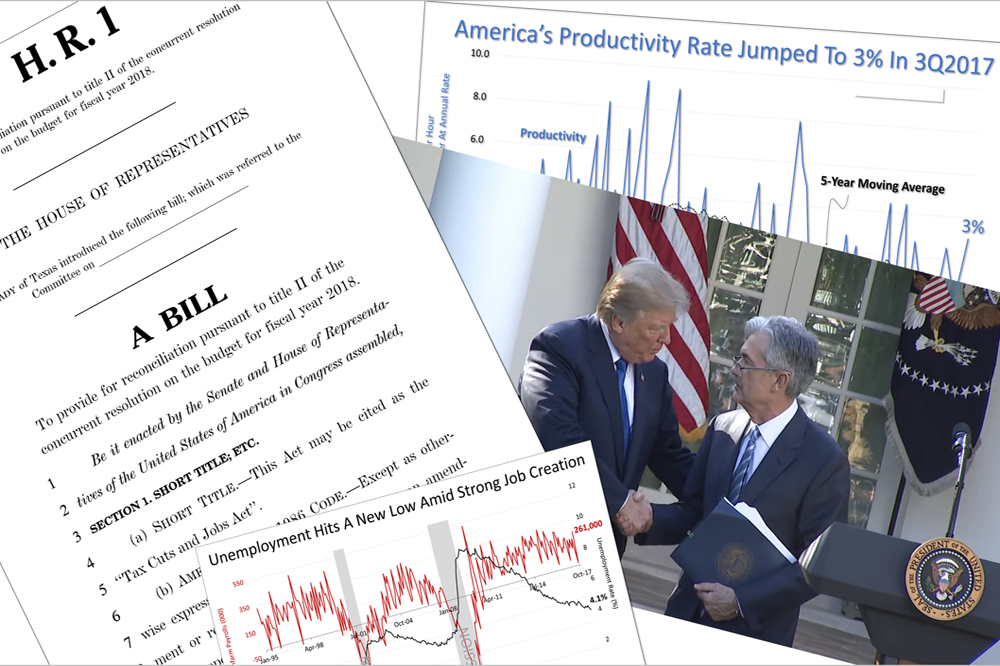

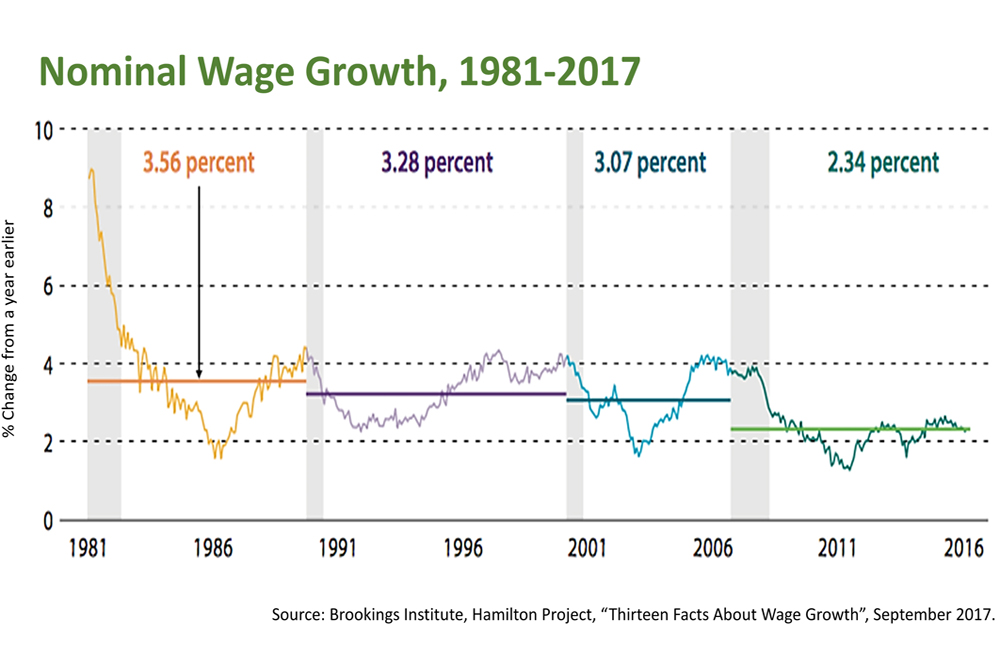

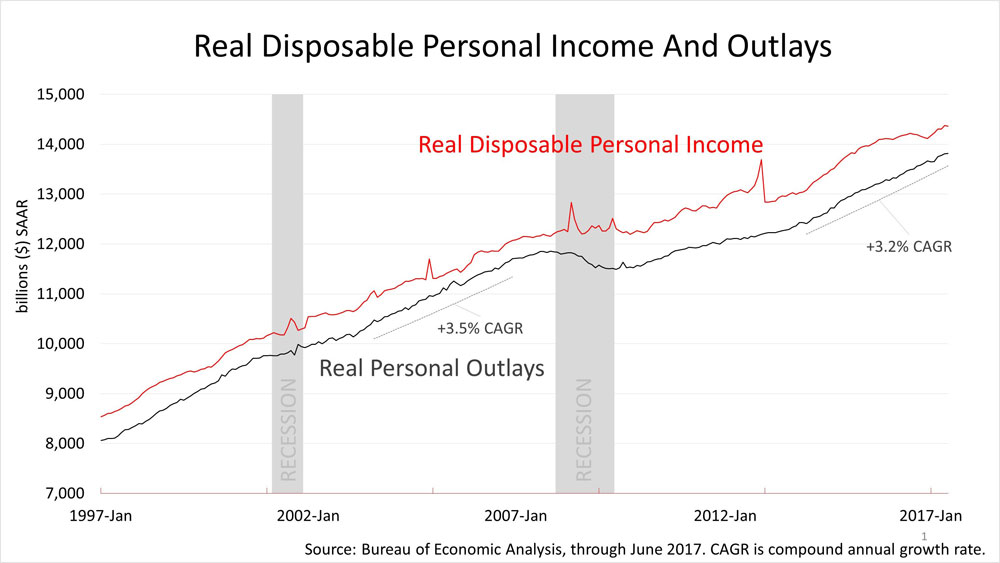

No one can predict the stock market’s next move, up or down. Investor sentiment almost always is capable of swinging stock prices 10% at almost any moment. Eventually, fundamental economic conditions bend market sentiment closer to reality and away from emotional swings, and currently, conditions are surprisingly strong.

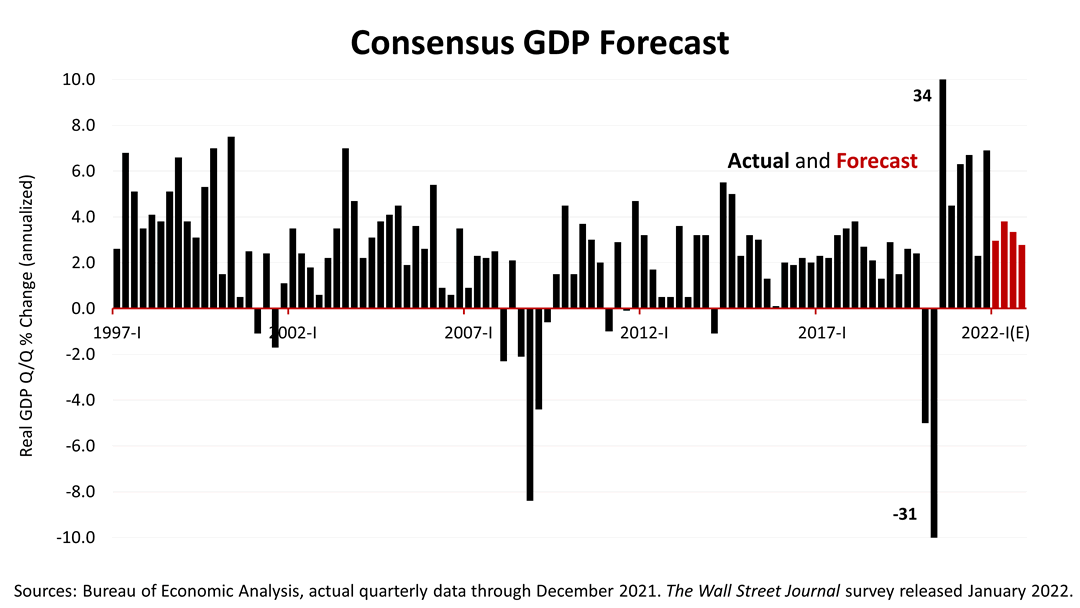

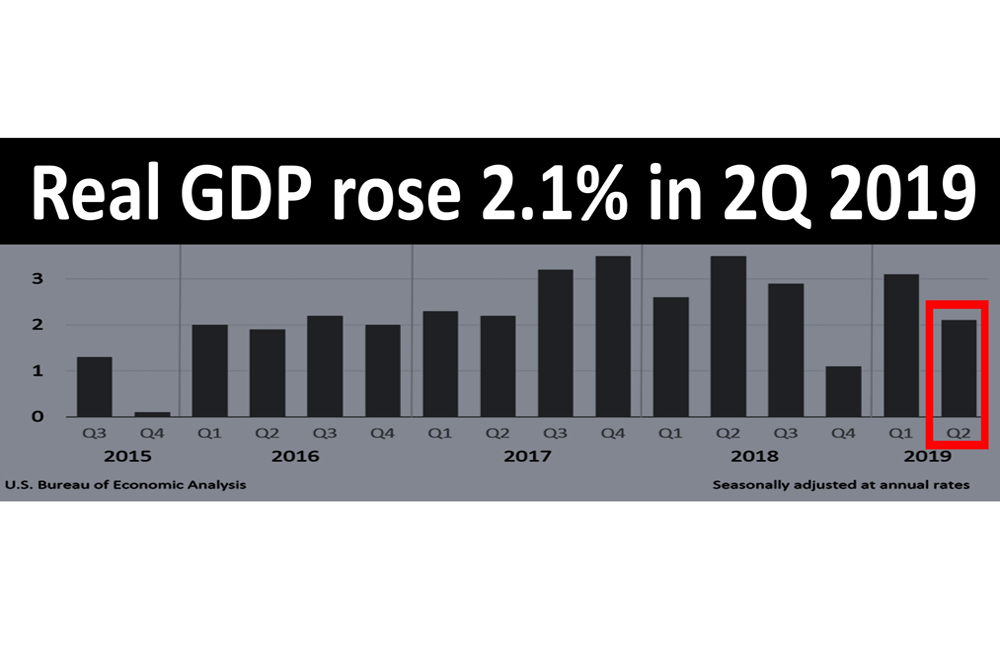

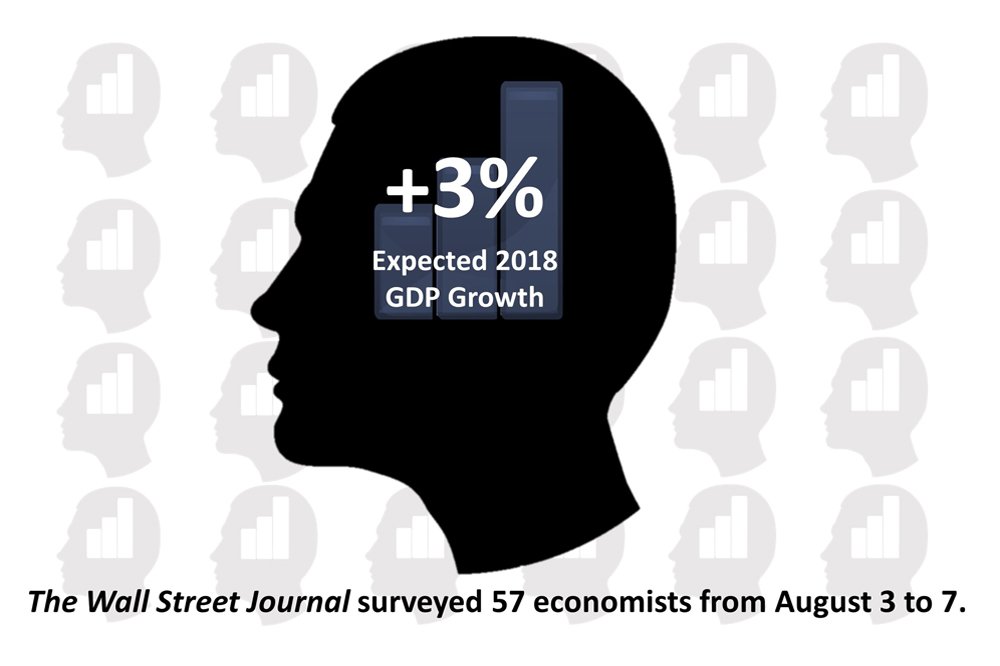

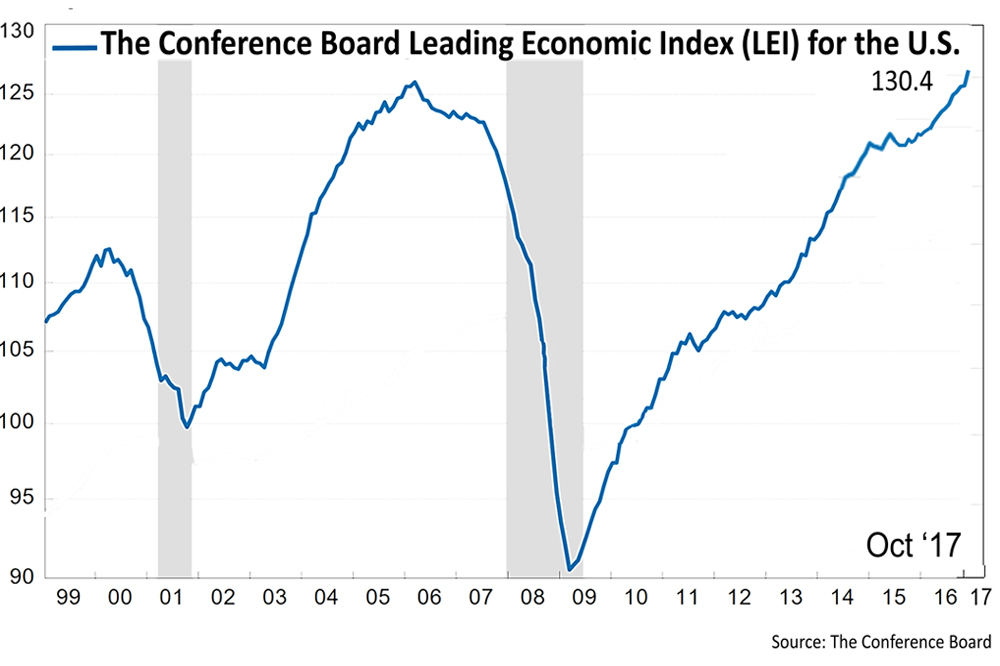

Economists surveyed by The Wall Street Journal in early January had predicted GDP growth of 5.8% for the final quarter of 2021. In a big surprise, the Bureau of Economic Analysis Thursday reported actual growth of 6.9% for the fourth quarter of 2021! It propelled a growth rate in 2021 of 5.7% -- the highest rate of growth since 1984!

With economists underestimating the strength of the U.S., economy at the end of 2021, it’s likely their forecasts for the current quarter are also low.

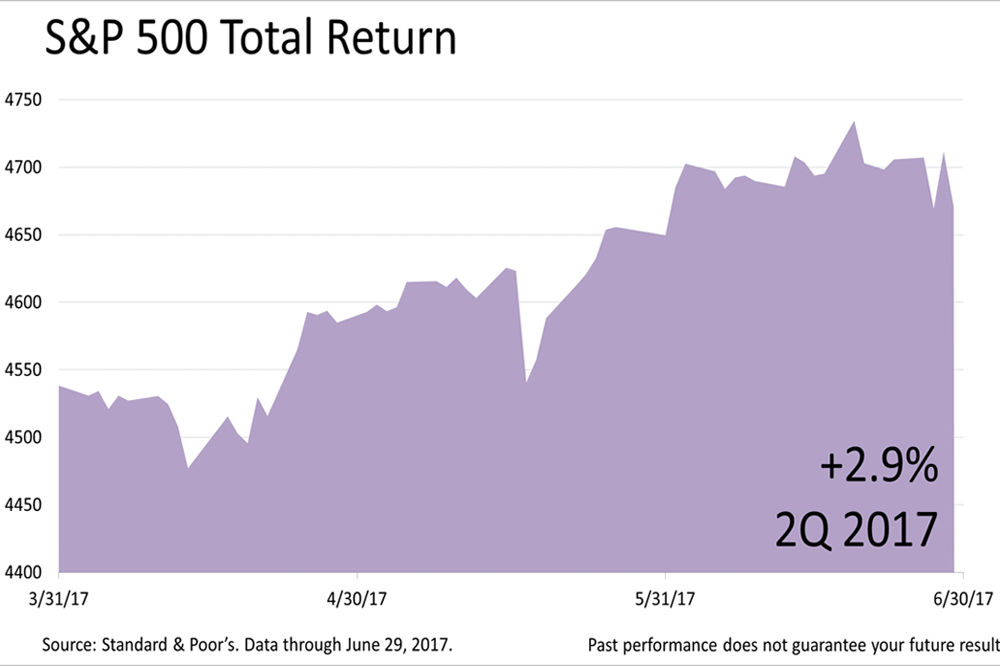

The Standard & Poor’s 500 stock index closed this Friday at 4,431.85. The index gained +2.43% from Thursday and was up +0.77% from last Friday. The index is up +65.81% from the March 23, 2020, bear market low.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

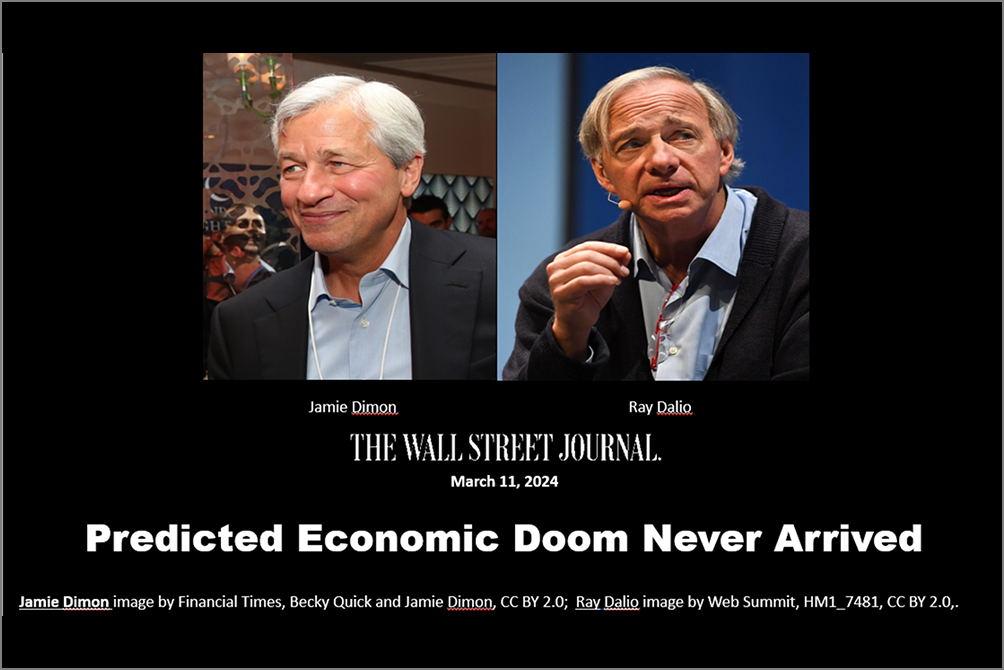

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding